Progress Report

Market Activity

Market Activity Figures

Last updated: 06/2019

Related Figures

Highlights

Transaction Types and Volumes

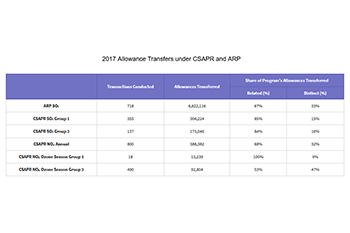

- In 2017, more than 970,000 allowances were traded across all five of the CSAPR trading programs.

- Just under one-quarter of the transactions within the CSAPR programs were between distinct organizations. In 2017, over 6 million ARP allowances were traded, the majority (67 percent) between related organizations.

2017 Allowance Prices1

- ARP SO₂ allowance prices averaged less than $1 per ton in 2017.

- CSAPR SO₂ Group 1 allowance prices started 2017 at $5.25 per ton and ended 2017 at $2.13 per ton.

- CSAPR SO₂ Group 2 allowance prices started 2017 at $5.25 per ton and ended 2017 at $2.63 per ton.

- CSAPR NOₓ annual program allowances started 2017 at $6 per ton and ended 2017 at $2 per ton.

- CSAPR NOₓ ozone season program allowances started 2017 at $525 per ton and ended 2017 at $175 per ton.2

- Allowance prices as reported by SNL Finance, 2017.

- These prices reflect CSAPR Update ozone season NOₓ allowances. In October 2017, EPA published an update to the CSAPR ozone season allowance trading programs. On October 23rd, 2017, most CSAPR ozone season NOₓ allowances were converted to CSAPR Update ozone season NOₓ allowances.

Background Information

Transaction Types and Volumes

Allowance transfer activity includes two types of transfers: EPA transfers to accounts and private transactions. EPA transfers to accounts include the initial allocation of allowances by states or EPA, as well as transfers into accounts related to set-asides. This category does not include transfers due to allowance retirements. Private transactions include all transfers initiated by authorized account representatives for any compliance or general account purposes.

To better understand the trends in market performance and transfer history, EPA classifies private transfers of allowance transactions into two categories:

- Transfers between separate and unrelated parties (distinct organizations), which may include companies with contractual relationships (such as power purchase agreements), but excludes parent-subsidiary types of relationships.

- Transfers within a company or between related entities (e.g., holding company transfers between a facility compliance account and any account held by a company with an ownership interest in the facility).

While all transactions are important to proper market operation, EPA follows trends in transactions between distinct economic entities with particular interest. These transactions represent an actual exchange of assets between unaffiliated participants, which reflect companies making the most of the cost-minimizing flexibility of emission trading programs. Companies accomplish this by finding the cheapest emission reductions not only among their own generating assets, but across the entire marketplace of power generators.

Allowance Markets

The 2017 emissions were below emission budgets for the Acid Rain Program (ARP) and for all five Cross-State Air Pollution Rule (CSAPR) programs. As a result, CSAPR allowance prices were well below the marginal cost for reductions projected at the time of the final rule, and are subject, in part, to downward pressure from the available banks of allowances.